Using an IRA to Support Multiple Nonprofits

ADVISOR RESOURCES

As a financial advisor, one of the best tips to give your clients is information about a unique option to donate to their favorite nonprofits. Through Community First Foundation, donors can use their Individual Retirement Account (IRA) to make a charitable distribution to support their favorite nonprofit organizations.

As a financial advisor, one of the best tips to give your clients is information about a unique option to donate to their favorite nonprofits. Through Community First Foundation, donors can use their Individual Retirement Account (IRA) to make a charitable distribution to support their favorite nonprofit organizations.

It is a good time to remind your clients who qualify for the required minimum distribution (RMD) the Internal Revenue Service (IRS) mandates each year from their tax deferred retirement accounts (such as IRAs) is tax free when used for a qualified charitable distribution. They can donate up to $100,000 per year from their IRA to a qualified nonprofit, such as Community First Foundation.

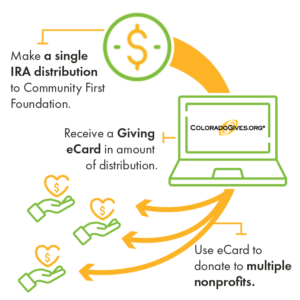

Community First Foundation takes the IRA giving option to the next level. After receiving the charitable distribution, Community First Foundation provides the donor with a Giving eCard in the full distribution amount. This eCard can be used any time of the year to support nonprofits featured on ColoradoGives.org, Community First Foundation’s online giving website. This process is not subject to federal income tax. In addition to providing your clients with tax advantages, the nonprofits your clients choose to support will receive the full amount of each donation.

“Community First Foundation’s IRA giving program is a valuable option I’ve added to my client toolkit,” says Julie Fletcher McDaniel, partner and financial planner at IMPACTfolio, LLC. “It is a wonderful opportunity for many of my clients to fulfill the required minimum distribution rule while giving back to their community in an impactful, meaningful and personal way.”

For donor Ariantha Stettner, Community First Foundation’s IRA giving program makes it easy for her to support the many causes she believes in. “While I can’t be a grand patron for just one cause, I can make modest gifts to several nonprofits,” explains Stettner. “Community First Foundation’s process lets me do my charitable giving through my IRA whenever I want to. I take my time and do it throughout the year. This program really is an extraordinary benefit.”

How Does Community First Foundation’s IRA Giving Program Work?

Getting your clients started with the Community First Foundation’s IRA giving program is an easy two-step process.

Step 1:

- Complete the IRA Letter of Intent and send to Community First Foundation via mail, email or fax. Community First Foundation’s contact information is included in the letter.

Step 2:

- Complete the IRA Distribution Request Letter and provide it to the IRA plan administrator.

The Giving eCards provided to your client between January and November must be redeemed in the same calendar year. Distributions received in December will receive a Giving eCard that can be redeemed by the end of the following calendar year. If your client does not use the eCard by the expiration date, the unused dollars will be redirected to Community First Foundation’s unrestricted fund and used for an area of need.

Community First Foundation is dedicated to improving the quality of life in Jefferson County, the Denver metropolitan area and beyond. Community First Foundation brings together individuals, families and businesses to support nonprofits and build communities where everyone can thrive. Learn More