Maximize Year-End Giving

Charitable giving is an important way to support nonprofits in your community and in your community and an important part of wealth management. Community First Foundation encourages you to consider the following tips to help take the stress out of giving and maximize your tax benefits.

Make a plan

Work with your financial advisor to make a plan that fits your situation. Think through how much money you’d like to contribute to nonprofits in a given year. You may also want to consider setting aside a certain portion of that money to put toward disaster relief or other one-time requests that may come up throughout the year.

Research the nonprofits you plan to support

Through Community First Foundation’s online giving website – ColoradoGives.org – you can learn more about many of Colorado’s nonprofits. All of the charities on ColoradoGives.org are recognized by the Internal Revenue Service (IRS) and the Secretary of State, are in good standing and are based in Colorado. You can also utilize websites like GuideStar and Charity Navigator to research the nonprofits you’re interested in.

Maximize your tax benefits

In most cases, if you’re itemizing your taxes, you can write off any charitable contributions (from an IRS-approved nonprofit) up to 50 percent of your adjusted gross income. You’ll just need a receipt of the transaction. People who donate assets (such as stock, bonds and property), rather than cash, may also receive a variety of tax breaks.

“Families with incomes under $200,000 who don’t have mortgages are better off taking the standard deduction. But families with mortgages can still itemize for mortgage and interest deductions and then receive additional deductions for charitable giving,” explains Leslie Schaus, a tax partner at Strategem CPA and a member of Community First Foundation’s Professional Advisors Council. “It’s good to remember that overall the tax rate has decreased by two percent. That means more resources left for charitable donations.”

Consider a donor-advised fund (DAF)

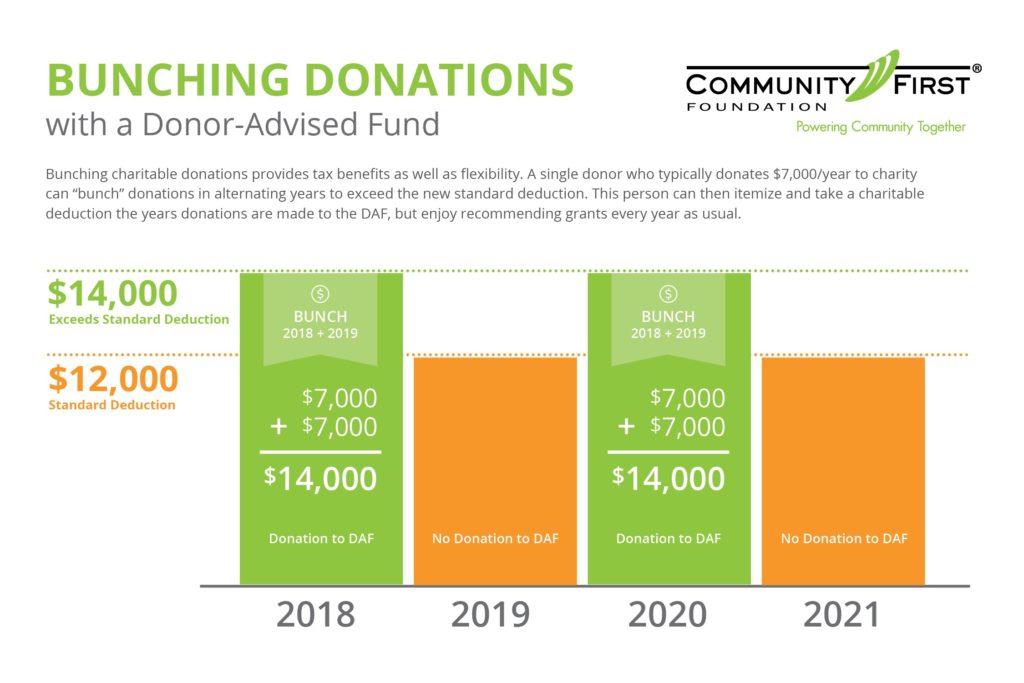

A donor-advised fund (DAF) is a charitable giving tool that allows individuals, families and businesses to support their favorite nonprofits over time while receiving an immediate tax benefit. The fund is managed by public nonprofits, such as Community First Foundation, and streamlines giving by serving as a single funding source. You should consider this option if you make numerous gifts throughout the year, have highly appreciated stock, have received an inheritance or would like to create a family culture of philanthropy.“Individuals or families can fund a DAF with either cash or appreciated assets and then bunch the donations to the DAF in alternating years. This may allow them to exceed the standard deduction and receive a charitable tax deduction while also giving them the flexibility to recommend grants to nonprofits whenever they wish,” explains Dan Morris, a financial advisor at High Point Financial Group and a member of Community First Foundation’s Professional Advisors Council.

Here’s how the “bunching” strategy works. Through a DAF, donors can contribute to up to two years of nonprofit donations in a single year. In the tax years when they have double-contributed, the donors may be able to itemize their deductions when filing their tax return. In the off years, the donors would claim the standard deduction on their tax return.The best charitable giving strategy for you depends on your individual tax and giving goals. Community First Foundation recommends all donors consult with their tax and wealth advisors to maximize the benefits of year-end giving and the available charitable deductions.

To learn more about Community First Foundation and donor-advised funds, please visit communityfirstfoundation.org/donors/ways-to-give/donor-advised-funds/