As Colorado and the nation struggle to understand all the implications COVID-19 is having on our lives, Community First Foundation is committed to working with the community to ensure an effective response to create lasting, tangible change in our community. We are dedicated to improving the quality of life in Jefferson County, the Denver metropolitan area and beyond by bringing together individuals, families and businesses to support nonprofits and build communities where everyone can thrive.

As nonprofits struggle to serve and survive, we are committed to using our energy, leadership and trusted stewardship of financial resources to energize giving across our state and find new ways to address community needs.

Nonprofits across the nation are feeling the impacts of the COVID-19 pandemic. Fundraising events are being postponed or canceled. Employees are struggling. Volunteers feel lost. The challenges are ongoing and many are unforeseen. The Community First Foundation has created the Jeffco Hope Fund to strengthen and stabilize Jefferson County community organizations responding to and impacted by COVID-19. We’ve seeded the fund with $1,000,000 and invite individuals, local business and other funders to contribute to help keep Jeffco strong.

#SpreadHopeCO #JeffcoHopeFund

May 7, 2020

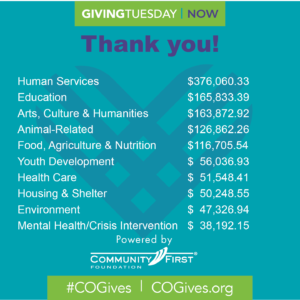

On May 5, 2020 for #GivingTuesdayNow, Colorado joined people around the world for a presentation of hope, generosity and kindness in a time when many continue to suffer from and realize the impact the pandemic is having on their lives, businesses and communities. Community First Foundation is humbled by the generosity of Coloradans who gave to 1,388 nonprofits on #GivingTuesdayNow. We recognize that money is tight and the future uncertain, but these challenges didn’t stop Colorado from trying to help, to stabilize our community, and help us recover.

Donations large and small, ranging from $10 to $15,000 streamed in throughout the day from 49 of Colorado’s 64 counties. We even saw donors from 46 other states supporting Colorado.

Donations large and small, ranging from $10 to $15,000 streamed in throughout the day from 49 of Colorado’s 64 counties. We even saw donors from 46 other states supporting Colorado.

As a Community Foundation, we play a key role in identifying and solving community problems. This is what we’re aiming to do with the creation of the Jeffco Hope Fund, serving as the fiscal sponsor for Make4CCovid and supporting #GivingTuesdayNow with our online giving platform, ColoradoGives.org.

Giving is easy to do anytime on ColoradoGives.org and doesn’t require a special day. Colorado donors are using the trusted online platform to support their favorite nonprofits everyday. In fact, the number of donations are up 122% from this time last year, and the monies raised are up 252%.

Read More

April 16, 2020

The Coronavirus Aid, Relief, and Economic Security (CARES) Act provides over $2 trillion of economic stimulus and contains several items that benefit the nonprofit sector. But making sense of the act can be challenging so we’re breaking down some of the biggest pieces to help you digest it.

In a nutshell, there are many provisions that benefit nonprofit sub-sectors, such as hospitals, education, the arts, and transit systems. The Act includes loan relief, payroll-related benefits, and a charitable contribution deduction incentive for individual and corporate donors. Explore some of these Act highlights, then consult your financial/tax advisor for specific applications to your organization.

GIVING

Yes! The CARES Act provides incentives for charitable giving.

Individual taxpayers who choose the standard deduction can now deduct up to $300 of cash contributions made in taxable years beginning in 2020 to qualifying charitable organizations. A “qualifying charitable organization” includes all charitable organizations to which donations are normally deductible.

Yes! Businesses can support nonprofits dealing with COVID-19 and get a benefit.

The CARES Act increases the amount corporations can contribute to “qualified contributions” from 10% to 25% of taxable income, less the amount of all other charitable contributions allowed under section 170(b)(1) of the Code, with a similar five year carry over allowance for excess contributions. The limit on food inventory contributions by corporations under section 170(e)(3)(C) of the Code is increased from 15% to 25%.

No! You can’t donate money to your donor advised fund and still get tax credit.

Donor advised funds are excluded.

LOANS

Yes. The CARES Act provides forgivable loans to some nonprofit organizations.

Charitable organizations exempt under section 501(c)(3) of the Code and Veteran organizations exempt under section 501(c)(19) of the Code with 500 or fewer employees are eligible to apply for the Paycheck Protection Program, a low-interest loan program under the CARES Act administered by the Small Business Administration (SBA). Eligible nonprofits may generally borrow an amount equal to two and a half times the average monthly payroll costs incurred during the previous year (up to $10 million) and the loan may be forgiven if the organization maintains its staffing levels for eight weeks after receiving the loan.

Yes. The CARES Act provides some paycheck protection.

Yes, sort of! Under a new Small Business Administration 7(a) loan guarantee program called the Paycheck Protection Program, funding is provided for special emergency loans of up to $10 million to eligible nonprofits and small businesses. Eligible nonprofits include Section 501(c)(3) organizations and veterans organizations under Section 501(c)(19) of the Internal Revenue Code. You can use the funds to cover limited operating costs, including payroll, rent, and utilities and some debt service expenses. Loans cannot be used to cover payroll costs related to wages already covered by the Families First Coronavirus Response Act or to cover the portion of compensation of individual employees or independent contractors in excess of an annual salary of $100,000. Eligible organizations must employ not more than the greater of 500 employees or the number of employees specified by the Small Business Administration for the industry in which the organization operates. A loan forgiveness provision is included with eligibility based upon maintaining employment and wage levels in place on February 15 from that date through June 30. We expect further guidance from the Small Business Administration soon.

There’s also an Employee Retention Payroll Tax Credit of 50% of “qualified wages” paid by eligible employers to certain employees during the COVID-19 crisis. Eligible employers include certain tax-exempt organizations carrying on a trade or business during calendar year 2020 whose operations have been fully or partially suspended as a result of a government order limiting commerce, travel or other group meetings. Organizations with a drop in gross receipts of at least 50% in the first quarter 2020 compared to the first quarter of 2019 are also eligible for the credit. Qualified wages include health benefits under employer-sponsored health plans.

The credit is capped at $5,000 per eligible employee which is 50% of the first $10,000 in qualified wages per eligible employee. The availability of the credit will continue each quarter until the organization’s gross receipts exceed 80% of the same quarter in 2019. For a tax-exempt organization, the entity’s whole operations must be taken into account when determining the decline in revenues. Employers receiving emergency small business interruption loans under the CARES Act and governmental employers are not eligible for these credits.

Yes! Nonprofits are eligible for Economic Injury Disaster Loans (EIDL).

This $10 billion program administered by the Small Business Administration provides private nonprofits that meet eligibility requirements under Section 7(b)(2) of the Small Business Act with loans of up to $2,000,000 and emergency advances of up to $10,000 within three days of application for the loan. To be eligible, you can have no more than 500 employees. The annual interest rate for nonprofit organizations is 2.75%.

Yes! Nonprofits are eligible for Economic Stabilization Loans.

Eligible businesses are defined as “a United States business that has not otherwise received adequate economic relief in the form of loans or loan guarantees provided under the Act.” Nonprofits are eligible under this section with the qualifying language “to the extent practicable.” Organizations with between 500 and 10,000 employees are eligible for these loans. Although there is no loan forgiveness provision, interest rates would be no higher than 2% and interest would not accrue nor payments be required for the first six months. Nonprofits accepting these loans must retain at least 90% of their staff at full compensation.

UNEMPLOYMENT

Yes! There are Partial Benefits Reimbursements for unemployment costs.

The federal government will reimburse states for half of the costs to provide unemployment benefits to laid-off employees of self-funded nonprofits. The intent is that the states would then reimburse the nonprofit employers.

April 15, 2020

Save the date!

On Tuesday, May 5, Community First Foundation is launching an emergency day of giving to support the emergency response to the unprecedented needs caused by COVID-19. This giving event is one way to begin the healing process and ColoradoGives.org provides a central, trusted place where donors can give.

On Tuesday, May 5, Community First Foundation is launching an emergency day of giving to support the emergency response to the unprecedented needs caused by COVID-19. This giving event is one way to begin the healing process and ColoradoGives.org provides a central, trusted place where donors can give.

To help Colorado nonprofits participate in and promote Giving Tuesday Now CO, we’ve created a toolkit. We hope that this is an easy, and optional, way for you to ask for donor support right now. We also recognize that you may not have the resources for another fundraising event, and that is OK too. Our hope is that all of the nonprofits on our site will benefit from this day of giving just from being on the site.

Donors can choose to support the Governor’s Help Colorado Now Fund, the Community First Foundation Jeffco Hope Fund, dozens of Colorado nonprofits with established COVID-relief funds, or any of the 2600+ nonprofits on ColoradoGives.org using one easy, safe and secure transaction.

Community First Foundation thanks the many nonprofits who are working tirelessly to provide emergency COVID relief. And, we support the nonprofits who are struggling to continue operations affected by COVID-economic stresses. We are with you as you strengthen and stabilize Colorado’s nonprofits community.

April 2, 2020

COVID-19 Funding Options for Jeffco Businesses

Friday, April 3 – online – 9 a.m. to 10:30 a.m.

Free.

Registration closes at 7 a.m. Friday.

Register for this free Coronavirus Workshop offered by Jeffco Business Resource Center and Jeffco Business and Workforce Center. The workshop aims to help educate business owners about how to secure funding amid the new coronavirus pandemic. A panel of experts offers advice for business owners in Jefferson County to help offset lost revenue and expenses due to COVID-19. Topics include: SBA Disaster Relief Fund, Traditional SBA Loans & Micro-Lending options and the necessary steps you need to receive funds.

Great resources you can use from the Centers for Disease Control and Prevention

Public Service Announcements

Share these public service announcements with clients and employees to help prevent the spread (available in English and Spanish).

Everyday steps you can take when someone is sick, and considerations for employers

Helpful tips and a printer friendly version you can share.

April 1, 2020

On April 1, one of the biggest influences on your funding occurs when Census 2020 counts begin.

The census is important to your nonprofit and to the causes you serve. Every person counted in our community will impact ten years of funding, representation and allocation of public services.

Census data guides the distribution of federal dollars that support key social services, health care and education programs in communities across the country, many of which are administered through nonprofits.

It also determines the number of seats each state has in the U.S. House of Representatives and its used to draw congressional and state legislative districts. Public infrastructure is influenced by the data to locate commercial, transit and schools.

For the first time in history, and fortunately for us as we shelter in place and practice social distancing, households can reply online, by phone, or by mail.

Nonprofits can act now by encouraging donors and friends to participate. Learn more.

March 30, 2019

Nonprofits across Colorado are mobilizing efforts to deal with the impacts of COVID-19. At Community First Foundation, we have more than 70 nonprofits currently using specific COVID-19 fundraising pages to support their relief efforts. More than 100 new Colorado nonprofits have applied through ColoradoGives.org, our fundraising platform, to begin using the site, and information shows donations are more than double what they were this time last year. People want to help. They want to do something to support their favorite organizations.

Community foundations like Community First Foundation are helping nonprofits connect people to nonprofits to solve community problems. According to the Council on Foundations, an estimated $5.48 billion was given in 2017 to a variety of nonprofits ranging from health and human services, to the environment, to arts and education. Disaster relief is another area where community foundations can quickly and efficiently support local communities during crises.

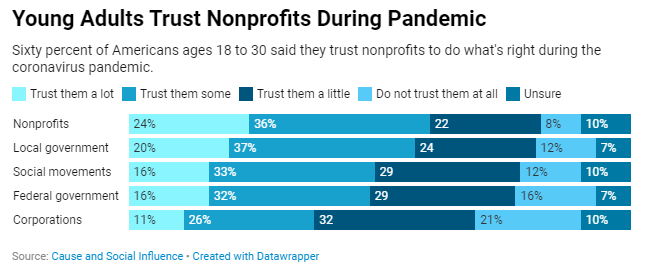

Research shows that young adults trust nonprofits more than government or corporations during the current COVID-19 crisis.

Trusted online giving through platforms like ColoradoGives.org give nonprofits an efficient way to respond to crises like Covid-19. Fundraising pages make it easy to set up an appeal to tell donors exactly what you are doing and what your needs are as you work through these challenging times. .

We applaud our regional champions who are supporting nonprofits across Colorado. Check out how Northern Colorado and Jefferson County are coordinating COVID-relief response efforts and spreading hope throughout our state.

Friday, March 20, 2020

On April 1, one of the biggest influences on your funding occurs when Census 2020 counts begin.

The census is important to your nonprofit and to the causes you serve. Every person counted in our community will impact ten years of funding, representation and allocation of public services.

Census data guides the distribution of federal dollars that support key social services, health care and education programs in communities across the country, many of which are administered through nonprofits.

It also determines the number of seats each state has in the U.S. House of Representatives and its used to draw congressional and state legislative districts. Public infrastructure is influenced by the data to locate commercial, transit and schools.

For the first time in history, and fortunately for us as we shelter in place and practice social distancing, households can reply online, by phone, or by mail.

Nonprofits can act now by encouraging donors and friends to participate. Learn more.

6 Ways We Can Help

Nonprofits around the nation are dealing with COVID-19 and wondering if now is the time to ask for help. Experts agree – yes! People feel helpless and donors want to help. Communicate your needs now. As the coronavirus quickly spreads across the country, your donors are looking for ways to support you.

Help them help you. Whether you’re asking for support, changing an in-person event to a virtual one, or trying to find ways to keep things going, ColoradoGives.org is a great option. Here are six ways you can use the online fundraising platform right now:

Find a COVID emergency fundraiser to support. Many local nonprofits have already established special fundraising pages.

Set up a COVID Emergency Response fundraising page for your nonprofit. Hint: Be sure to use the word “COVID” in your page so it appears on our highlighted nonprofit page.

Canceling an event? Set up a virtual event and fundraise virtually. You can even have your CEO and some of your nonprofit ambassador’s host Facebook Live events to support it.

Host a flash fundraiser. It’s quick and easy. Whether it’s 24-hours or a week, you choose the time and duration. By creating a compressed timeline of when the flash fundraising is happening, you encourage people to take action now. See if you can get someone to match all the donations you raise in that time period.

Look into using robocall technology to activate your donor base. It is more affordable than you think and can cost less than $100 for 100 calls. Many of your donors are home feeling powerless. A robocall might get their attention and remind them that they can take action right now. Make sure your message is short with a quick call to action encouraging donors to give. One provider is Robotalker. They offer a monthly option, protect information, and offer discounts for nonprofits. They also have a pay-as-you-go option. Other providers to research include: Call-Em-All and CallHub.

Launch a positive social media campaign. This is a stressful time for everyone. Explore how you can incorporate positive messaging into a mini social fundraising campaign.

Philanthropy Colorado is gathering needed information from Colorado’s nonprofit organizations about the impact of COVID-19. Your participation and input are critical; please click the button below and complete our brief survey. Take Philanthropy Colorado’s survey and help gather information on the impact of this crisis.

Take the Survey

Global health and governmental agencies are grappling with how best to fight the new coronavirus (COVID-19). Colorado’s nonprofits are facing unprecedented challenges that will continue for months to come and leaders at nonprofit organizations can also play a critical role in aiding response.

Many nonprofits suddenly have their entire workforce working remotely and are looking for resources to help employees stay connected and productive. Here are some excellent tools you can use to stay connected and productive.

The National Council of Nonprofits offers great suggestions on other things nonprofits can do. The page is being updated regularly with the latest information and resources that nonprofits can use to prepare and respond.

Working from home because of COVID-19? Here are five ways nonprofit employees can spend their time.

What ideas do you have for making the most of this time? Share them with us at info@Communityfirstfoundation.org

Colorado Lending Source offers resources for nonprofits and small business owners to help navigate the impact of COVID-19.

While physical offices are closed, they are available by phone, email, or virtual meetings at 303.657.0010.

The Small Business Association (SBA) is preparing to provide Economic Injury Disaster Loan assistance to all affected areas. Colorado and the counties within have not been added to the list yet updates will be posted here.

You can visit the SBA’s website to directly apply for an Economic Injury Disaster loan once your community has been added to the list of those eligible. In short these loans for up to $2 million in financing may be used to pay fixed debts, payroll, accounts payable and other bills that can’t be paid as a result of the disaster’s impact, at interest rates of 3.75% (for profits), and 2.75% (non profits).

Several Response Funds for COVID-19 have been established in Colorado:

Philanthropy Colorado